Buying into a franchise isn’t about finding an empty space; it’s about securing a territory with a high, untapped sales ceiling.

- True territory analysis goes beyond a simple competitor map; it involves calculating a quantitative “Saturation Index.”

- The “Exclusive Territory” clause in your contract has critical exceptions that can expose you to in-brand competition from sister brands or online sales.

Recommendation: Before signing, build a complete “competitive topography” map that layers demographic data, contractual DNA, and physical location analysis to see the true growth landscape.

For any prospective franchisee, the greatest fear is investing at the peak. You find a compelling brand, identify a promising area, but a nagging question remains: is the golden era over? Are you buying the last available plot in a territory that’s already reached its maximum potential? The common advice is to “do your research” or “look at a map of competitors.” While not wrong, this approach is dangerously superficial. It treats the market like a flat board game, ignoring the complex, three-dimensional landscape of modern commerce.

A truly strategic evaluation requires you to think like a geographer and a lawyer simultaneously. It’s not just about counting rival storefronts. It involves understanding the demographic currents, the legal contours of your contract, and the subtle economic signals that predict a market’s tipping point. The real key isn’t just identifying where competitors are now, but understanding the “sales ceiling” of the territory—the absolute maximum revenue it can sustain. This requires decoding the area’s competitive topography and its contractual DNA.

This guide moves beyond simplistic advice. We will provide a framework for dissecting a territory’s true capacity. We will explore how to map not just competitors but also cannibalization risks, decode the fine print of your “exclusive” rights, and calculate a tangible saturation score. By the end, you will have a clear methodology to distinguish a territory ripe for growth from one that is already maximized.

This article provides a detailed roadmap for your analysis. The following sections break down each critical step, from geographic mapping and contract analysis to calculating market capacity and selecting the right physical location.

Summary: How to Ensure You Aren’t Buying a Territory That Is Already Maximized?

- How to Map Competitors and Cannibalization Risks in a 5-Mile Radius?

- What Exactly Does “Exclusive Territory” Protect You From in the Contract?

- When Sister Brands Eat Your Lunch: Managing Portfolio Overlap

- How to Calculate the “Cap” on Sales for Your Specific Service Area?

- Where to Grow When Your Home Market Is Sold Out?

- The Saturation Signal Most Buyers Ignore Until It Is Too Late

- How to Prevent the Landlord from Renting to a Competitor Next Door?

- Corner Lot or Strip Mall: Which Location Type Yields the Highest Traffic per Dollar?

How to Map Competitors and Cannibalization Risks in a 5-Mile Radius?

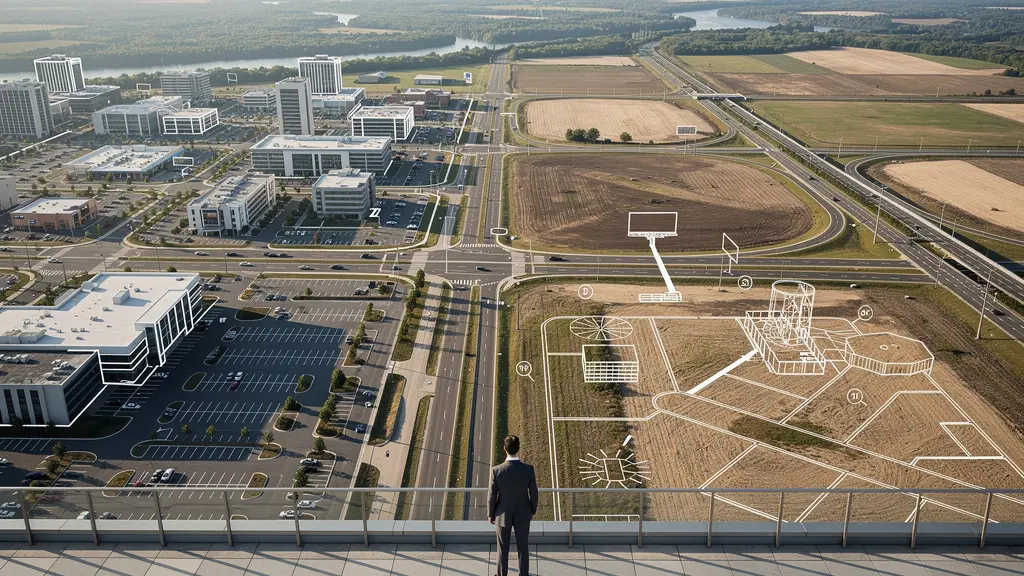

The first step in assessing a territory is to move beyond a simple list of addresses and create a “competitive topography” map. This is not just about plotting competitors; it’s about understanding their density, reach, and the demographic terrain they occupy. The goal is to visualize the market’s pressure points. Modern Geographic Information System (GIS) software is an indispensable tool here, allowing you to layer demographic data (like age, income levels, and household density) over a map of existing businesses.

A key benchmark for this analysis is population density. For instance, market saturation analysis suggests a healthy ratio for many service franchises is around one unit per 25,000 to 50,000 people. If your five-mile radius already contains multiple competitors serving a population of 75,000, the market may be approaching its capacity. This initial mapping should distinguish between direct competitors (same brand or service) and indirect competitors (offering substitute products). This detailed visualization helps you see not just where the competition is, but where the remaining pockets of opportunity—the “valleys” in the topography—truly lie.

This heat map approach, as shown above, transforms abstract data into a clear visual narrative. Red zones indicate high saturation where customer acquisition costs will be high, while green zones highlight untapped demographic clusters. This process is crucial for defining your own exclusive operational zones with clear territorial demarcation, ensuring you are targeting a viable customer base from day one.

What Exactly Does “Exclusive Territory” Protect You From in the Contract?

Once you have a geographic understanding of the market, you must analyze its legal boundaries. Many investors are placated by the term “exclusive territory” in a franchise agreement, assuming it grants them a fortress against all same-brand competition. This is a critical misunderstanding. The protection offered by this clause is defined entirely by the fine print in Item 12 of the Franchise Disclosure Document (FDD), and its strength can vary dramatically.

An FDD analysis reveals that franchisors differ significantly on territory protections. Some mature, fixed-location retail franchises may offer no territory protection at all, reserving the right to open other locations or sell products through alternative channels within your area. These “carve-outs” are the most common source of conflict. Your “exclusive” rights might not protect you from sales made online, at special venues like airports or stadiums, or through a sister brand owned by the same parent company. Understanding these exceptions is paramount to evaluating your long-term security.

The following table illustrates the real-world differences between common territory arrangements. It clarifies what you are truly getting and what risks you are accepting with each model.

| Territory Type | Protection Level | Growth Potential | Competition Risk |

|---|---|---|---|

| Exclusive Territory | Full protection from same-brand competition | Limited to defined boundaries | Low internal, high external |

| Non-Exclusive | No protection from same-brand units | Flexible expansion opportunities | High internal and external |

| Protected with Exceptions | Partial protection with carve-outs for online/special venues | Moderate flexibility | Medium risk level |

When Sister Brands Eat Your Lunch: Managing Portfolio Overlap

One of the most insidious forms of saturation comes not from direct rivals but from within the franchisor’s own portfolio. A parent company may own multiple brands that, while distinct on paper, appeal to a similar customer base. For example, a fast-casual sandwich shop and a gourmet soup-and-salad cafe under the same corporate umbrella can inadvertently compete for the same lunchtime crowd. This “portfolio overlap” can lead to sales cannibalization, where you are effectively losing customers to a sibling brand that your own franchise fees helped build.

This risk is often not explicitly addressed in the FDD’s territory protection clauses, which typically focus on the placement of same-brand units. Therefore, your due diligence must include a thorough analysis of the franchisor’s entire brand family. Identify all brands under the parent company and map their locations relative to your proposed territory. Assess the degree of overlap in their target demographics, price points, and product offerings. This is a crucial part of understanding the true competitive pressure you will face.

As one legal expert on franchise territories notes, this internal competition can be just as damaging as external threats. Attorney Aaron Hall, in his analysis of franchise restrictions, highlights the danger:

When franchisees operate in close proximity, they may end up competing for the same customer base, ultimately leading to cannibalization of sales and revenue. This not only hurts individual franchisees but also erodes franchise harmony and overall brand value.

– Attorney Aaron Hall, Franchise Territory Analysis and Restrictions

How to Calculate the “Cap” on Sales for Your Specific Service Area?

A qualitative sense of saturation isn’t enough; strategic investors need a quantitative measure. The “sales cap” is a theoretical calculation of the maximum revenue your territory can generate based on its demographic profile and the existing level of competition. While it’s an estimate, it provides a crucial benchmark for evaluating a territory’s remaining growth potential. The first step is to establish a revenue-per-household baseline from the franchisor’s FDD (Item 19), if available.

For example, a 2024 FDD analysis for one franchise brand shows an average of $155,000 in sales for territories of approximately 125,000 households. If your target territory has 200,000 households but already has a competing unit, you can’t assume you’ll capture the full market. You need to adjust your potential revenue downward based on the saturation level. A practical method is to calculate a Market Saturation Index, which provides a concrete score for your service area.

This calculation requires a systematic approach to data collection and analysis. It combines competitor presence with market size to produce a single, comparable metric that helps you benchmark different territories against each other.

Your Action Plan: Calculating the Market Saturation Index

- Identify Data Points: List all necessary data sources for your analysis. This includes GIS software for demographic data (population, income), the FDD (Item 12, Item 19), local business directories for competitor locations, and municipal economic reports.

- Collect Competitor and Demographic Data: Inventory every direct and indirect competitor within your target radius. Simultaneously, gather key demographic statistics for the same area, such as total households, median income, and population density.

- Assess for Coherence: Confront your collected data with the franchisor’s promises. Does the number of existing sister brands conflict with the spirit of your “exclusive” territory? Do the demographic realities support the revenue claims in the FDD?

- Calculate the Quantifiable Signal: Apply the formula: (Number of Direct Competitors x Their Estimated Market Share) / Total Addressable Market = Market Saturation Index. This transforms a generic feeling of “crowded” into a specific score you can track and compare.

- Create an Integration Plan: Based on the Saturation Index and your contractual analysis, define your go/no-go criteria. If the index is above a certain threshold, the territory is likely maximized. If it’s low, define clear boundaries for your initial and future growth phases.

Where to Grow When Your Home Market Is Sold Out?

What happens when your analysis confirms your fears: your primary target market is indeed saturated or sold out? For an ambitious entrepreneur, this isn’t an ending but a strategic pivot. The solution often lies in adjacent market development or a multi-unit expansion strategy. Instead of focusing on a single, dense urban core, you can look to contiguous suburban areas or smaller, underserved towns that fall just outside the primary competitive radius.

This strategy requires the same rigorous mapping and analysis, but applied to a portfolio of territories. Many successful franchisees build their enterprise value not from a single flagship location but by strategically acquiring a cluster of territories. This approach allows them to dominate a wider geographic region, achieve economies of scale in marketing and operations, and build a defensive moat against new competitors. Franchisors often favor multi-unit operators, as they are proven partners, which can give you preferential access to newly available adjacent territories.

The key is to find the “sweet spot” where consumer demand is growing faster than the supply of services. Entering a market at this precise moment is a strong predictor of success. As franchise development experts point out, timing is critical. According to one analysis, this strategic entry is a powerful driver of early profitability.

This approach transforms the problem of a single sold-out market into an opportunity to build a larger, more resilient business empire. It shifts the mindset from “owning a spot” to “commanding a region.”

The Saturation Signal Most Buyers Ignore Until It Is Too Late

Market saturation doesn’t happen overnight. It is a gradual process preceded by subtle warning signs that most investors, focused on the brand’s appeal, tend to ignore. While the U.S. franchise industry is a massive economic engine, with industry statistics revealing over 831,000 establishments generating nearly $900 billion in output, this growth creates intense pockets of competition. Recognizing the early tremors of saturation is what separates a savvy investor from a cautionary tale.

One of the most overlooked signals is the franchise resale market. A high volume of existing franchisees in a specific area trying to sell their businesses can be a red flag. It may indicate that profitability is declining and operators are trying to get out before the market dips further. Another powerful, yet often ignored, indicator is the rising cost of digital advertising. If the bid prices for local keywords on platforms like Google Ads have doubled in the last 24 months, it’s a clear sign that more competitors are fighting for the same limited pool of online customers.

These leading indicators provide a real-time pulse on market health, often appearing long before revenue declines are reported in FDDs. Monitoring them is a proactive way to gauge the competitive temperature of a territory. Here are some key early warning signals to track:

- Franchise Resale Sites: A surge in listings for your target brand in a specific geographic area points to potential franchisee distress or declining profitability.

- Digital Advertising Costs: A sustained, significant increase in cost-per-click (CPC) for core service keywords indicates heightened competition for customer attention.

- Foot Traffic Patterns: If data shows declining foot traffic to similar businesses in the area despite a healthy economy, it may suggest customer fatigue or market exhaustion.

- Local Economic Indicators: Negative trends in local unemployment rates, median income, or an exodus of other small businesses can signal a weakening addressable market.

Key Takeaways

- True territory analysis requires building a “competitive topography” map that layers demographic data over competitor locations.

- Your “exclusive territory” is only as strong as its contractual DNA; always scrutinize the FDD for carve-outs like online sales or sister-brand rights.

- Quantify market saturation by calculating a Sales Cap and a Saturation Index, turning abstract risk into a concrete metric.

- Protect your physical location by negotiating strong, use-based restrictions in your lease to prevent a direct competitor from moving in next door.

How to Prevent the Landlord from Renting to a Competitor Next Door?

Your territory protections from the franchisor are only half the battle. The other front line is your commercial lease. Even with a contractually “exclusive” territory, there’s often nothing stopping your landlord from renting the vacant unit next door to your biggest direct competitor. This micro-market saturation can be devastating, immediately siphoning off foot traffic and revenue. Securing protection within your lease agreement is a non-negotiable step for any brick-and-mortar franchise.

The key is to negotiate an “exclusivity clause” directly into your lease. However, not all exclusivity clauses are created equal. A weak, name-based restriction that only prohibits the landlord from renting to a specific brand (e.g., “no other Subway”) is easily circumvented. The competitor can simply be a different brand offering the exact same products. A much stronger approach is a use-based restriction.

This type of clause prohibits the landlord from renting to any other tenant whose primary business is the sale of a specific product or service (e.g., “no other business whose primary revenue is from the sale of made-to-order sandwiches”). This provides far more robust protection. The following table compares different lease protection strategies, highlighting their relative strength and enforceability.

| Protection Type | Scope | Enforceability | Negotiation Leverage |

|---|---|---|---|

| Use-Based Restriction | Prohibits tenants earning >10% revenue from specific items | High – objective criteria | Strong |

| Name-Based Restriction | Prevents specific brand names only | Low – easily circumvented | Weak |

| Radius Restriction | Applies to all landlord properties within 1-2 miles | Medium – depends on landlord portfolio | Moderate |

| Primary Revenue Source | Blocks competitors by main income source | High – clear definition | Strong |

Corner Lot or Strip Mall: Which Location Type Yields the Highest Traffic per Dollar?

The final layer of your territory analysis is the physical site itself. Even within a promising territory, the specific location—a standalone corner lot versus a unit in a strip mall—can dramatically affect your visibility, accessibility, and ultimately, your revenue. The choice is not just about rent; it’s about maximizing your return on every occupancy dollar. A strategic evaluation looks beyond the address and analyzes the site’s performance potential based on quantifiable metrics.

While territory planning data shows that most retail concepts find their sweet spot within a 1-5 mile radius, the type of location within that radius matters immensely. A corner lot offers high visibility from multiple streets but may suffer from difficult entry and exit points (ingress/egress). A strip mall location benefits from the “co-tenancy lift” of anchor stores like supermarkets, which generate consistent foot traffic, but you might be lost among a sea of other businesses. To compare them objectively, calculate the Cost Per Visible Car: divide your annual rent by the total daily traffic count. This metric helps normalize the cost of visibility between different site types.

Beyond traffic counts, a full ROI evaluation should score factors like the ease of making a left turn into your parking lot, the visibility of your signage, and the halo effect from nearby businesses. A location next to a busy coffee shop may be more valuable than one with higher car traffic but no complementary businesses. Analyzing these micro-factors ensures your chosen site is not just in the right territory, but in the optimal position within it.

Apply this multi-layered strategic framework to your next franchise evaluation. By moving beyond a simple map and analyzing the competitive topography, contractual DNA, and physical site characteristics, you can transform a potential risk into a calculated, high-growth investment.